Did you know that web hosting fees are tax-deductible for business owners? These costs typically qualify as ordinary business expenses, whether you pay monthly or annually. You can also deduct related expenses like domain registration, website design, development costs, and necessary software. Keep detailed records of all website-related expenses and report them on Schedule C of your tax forms under appropriate categories like “Advertising,” “Office expense,” or “Utilities” to maximize your tax savings.

Are web hosting fees tax-deductible? Tax season is here, making it a great time to review what expenses you can claim to maximize your return. If you run a small business, several deductions, like web hosting, can help you keep more of your hard-earned money.

The short answer is yes, web hosting fees can be tax-deductible! But as with most tax topics, the full answer depends on a few important details.

In this guide, you’ll learn when web hosting costs are deductible and how to claim them on your return. You’ll also discover other technology-related expenses you might be missing that could boost your tax refund.

*Please note: This information applies only to U.S. residents and U.S. taxes and should not be considered legal or tax advice.

What is a Tax Deduction?

A tax deduction reduces the amount of taxable income, lowering the amount an individual or business owes to the government.

Deductions are usually expenses over a taxable year that can be applied to or subtracted from your gross annual income. This is done to reduce the taxes you owe and determine how much tax is owed to the government.

Tax deductions should not be confused with tax credits. While deductions can reduce the amount of your income before you calculate the tax you owe, tax credits can reduce the amount of tax you owe.

Simply put, tax deductions reduce how much you pay in taxes by lowering your amount of taxable income.

The federal tax law allows taxpayers to deduct several different personal expenses from their taxable income each year.

Not every expense provides tax savings; the Internal Revenue Code specifies the expenses you can deduct and those eligible taxpayers. To ensure proper handling of deductions, visit the IRS’s Credits and Deductions page.

Are Web Hosting Fees Tax-Deductible?

Now that we know what tax deductions are, let’s discuss their application to web hosting fees. The short answer is yes, you can deduct these fees from your taxes along with other online business expenses.

Although the IRS hasn’t provided formal guidance on deducting website costs, web hosting costs fall under dues and subscriptions, making them deductible on your return. Generally, the IRS rules outlined for software can be applied.

Special Considerations for Different Business Types

How you deduct web hosting costs depends on your business structure. Sole proprietors, LLCs, and corporations all report business expenses differently, including website-related fees.

Sole proprietors and single-member LLCs typically report expenses on Schedule C of Form 1040. If you use web hosting for your business website, you can deduct those fees as a business expense in the relevant category (often “advertising” or “utilities”).

Partnerships and multi-member LLCs must file Form 1065 and issue Schedule K-1s to partners. Web hosting fees should be tracked throughout the year and reported as part of ordinary business expenses.

Corporations (C corps and S corps) deduct hosting and digital services as operational costs on their corporate tax returns (Form 1120 or 1120-S). These expenses must be documented with receipts or digital invoices and should be tied directly to business activity.

No matter your business type, it’s important to ensure that web hosting costs are used primarily for business purposes. Personal sites generally don’t qualify unless there’s a clear business function, like showcasing a portfolio that drives client income.

What Other Website-Related Fees are Deductible?

Thankfully for business owners, website hosting fees aren’t the only website-related costs you can deduct from your taxes.

In addition to web hosting, you can typically deduct a range of website-related expenses essential to running your business. Here’s a closer look at some common deductions you might qualify for:

Internet Services

If you rely on internet access for daily business operations, part of your internet service fees can be deducted as a business expense. If you also use the internet personally, you can deduct the percentage of time it’s used for business.

Website Design and Development

Hiring a professional to design, build, or maintain your website qualifies as a deductible business expense. If you pay a freelancer or contractor $600+ in a year, you’ll need to issue them a 1099-NEC form.

Domain Registration Fees

The cost of registering and renewing your domain name is typically deductible as either an operational or marketing expense. Keep detailed records and receipts for at least four years, in case of an IRS audit.

Software and Website Applications

Software used to build, manage, or enhance your website can be deducted. Examples include content management systems (CMS), security plugins, backup tools, or analytics software. To qualify, the software must be used primarily for business purposes (at least 50% or more).

Online tools, Subscriptions, and Templates

Stock images, paid website themes, eCommerce plugins, SEO tools, and other online resources you purchase for your website are deductible. Always track invoices and note whether the tool directly supports your business activities.

Payments to web designers or content creators are deductible, too. If you pay an independent contractor $600+, issue a 1099-NEC. Domain fees and business-use software (used at least 50% for business) also qualify. Keep records for at least four years for potential audits.

Additionally, you can deduct website maintenance and growth costs–like templates, stock images, plug-ins, and online tools–if your site supports your business income.

Unfortunately, when it comes to reseller web hosting, client web hosting costs can not be deducted or claimed since your client pays for this cost when they pay you for the server.

If you operate a reseller hosting business, you typically cannot deduct the web hosting costs associated with your clients’ accounts. When your clients pay you for hosting services, those payments cover the server resources you provide, meaning the costs are effectively passed through to them, not expenses you incur. As a result, you cannot claim these client-related hosting fees as your business deductions.

However, you can deduct expenses related to maintaining and operating your reseller business itself. This includes the base cost of your reseller hosting plan, administrative tools, billing software, marketing expenses, and any additional services you purchase to manage your hosting business. To stay compliant, be sure to separate client charges from your operational costs and maintain detailed records of all business-related expenses throughout the year.

Properly tracking your deductible expenses throughout the year makes it easier to claim them correctly when it’s time to file your taxes.

Tax Implications of Different Payment Terms

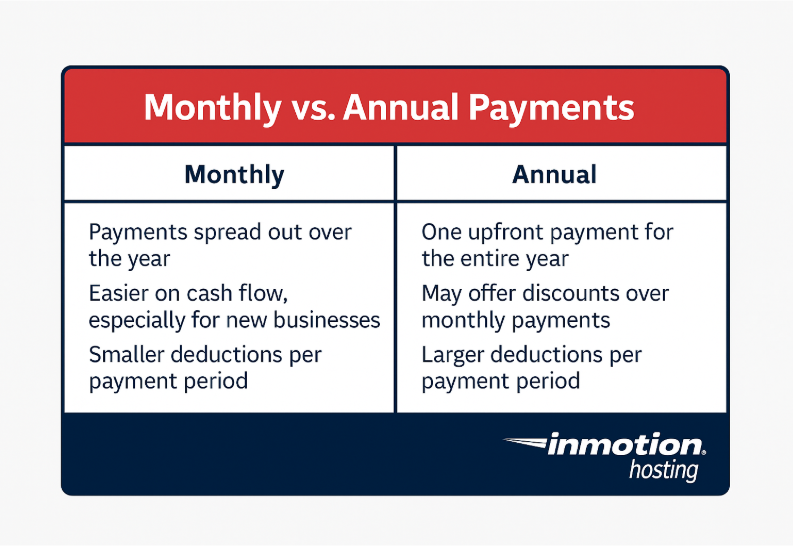

How you pay for web hosting—monthly or annually—can affect when and how you deduct those expenses on your taxes. Both payment options are typically deductible, but timing matters for accurate reporting.

Monthly payments

If you pay for web hosting on a month-to-month basis, you can deduct each payment as a business expense in the tax year you made the payment. This approach is straightforward and allows you to align your deductions closely with your monthly income and expenses. Monthly billing can also make it easier to manage cash flow, especially for newer businesses with variable revenue.

Annual payments

When you pay for hosting or related services upfront for the entire year, you can usually deduct the full cost in the year you make the payment. However, in some cases—especially for larger businesses using accrual accounting—you may need to allocate the expense over the service period instead of deducting it all at once. Most small businesses that use cash accounting can deduct the full annual payment in the year it is paid, which may offer a larger one-time deduction and help lower taxable income more significantly.

Before choosing a payment schedule, consider your business’s accounting method and cash flow needs. Keeping detailed records of your payment dates and terms ensures you can maximize your deductions while staying compliant with IRS requirements.

How to Deduct Website-Related Fees From Your Taxes

Web hosting fees and the other expenses we mentioned can be tax-deductible. That’s great news, but how does one go about claiming those deductions?

Tax forms have a plethora of sections, but when it comes to web hosting fees and other deductions, you will want to file those under “Schedule C – Profit or Loss from Business.”

This section is part of an individual’s IRS Form 1040, and it shows the business’s income for the tax year. This is where you will want to enter your deductible expenses.

Under Schedule C, find “Part II, Expenses”, and fill out the entry that best matches the deduction. From what we have discussed in this article, the most likely area to claim these deductions would be under these entries:

#8: “Advertising”

#18: “Office expense”

#25: “Utilities”

#27a: “Other expenses”

Tax Strategies for Different Business Types

The way you deduct web hosting costs and other online business expenses depends heavily on your business structure. Whether you’re a sole proprietor, LLC, partnership, or independent contractor, it’s important to understand the strategies that fit your situation to maximize your deductions and stay compliant with tax laws.

Sole proprietors and single-member LLCs

If you operate as a sole proprietor or a single-member LLC, you typically report business income and expenses on Schedule C of your Form 1040. You can deduct website-related expenses like hosting fees, domain costs, internet services, and marketing as part of your general business expenses. Since your personal and business taxes are tied together, tracking deductible costs throughout the year can significantly lower your taxable income.

Partnerships and Multi-Member LLCs

For partnerships and multi-member LLCs, deductions flow through to individual partners via Schedule K-1 after filing Form 1065. It’s critical to document web hosting and related digital expenses clearly so that each partner claims the correct share. Consider creating an internal expense tracking system that categorizes technology costs separately to simplify end-of-year filings.

Corporations (C Corps and S Corps)

Corporations file separate business tax returns (Form 1120 for C Corps or Form 1120-S for S Corps). These entities can deduct web hosting and digital service expenses as operational costs, but it’s essential to maintain thorough records showing that these expenses are necessary for running the business. Corporations may also benefit from additional deductions, like Section 179 deductions for software purchases, depending on their total business spending during the year.

Nonprofit organizations (501(c)(3))

While nonprofit organizations are tax-exempt, they still file annual information returns such as Form 990. Hosting and website-related expenses that directly support your nonprofit’s mission, such as hosting for donation platforms or awareness campaigns, can be reported as operational costs. Maintaining detailed records is essential to demonstrate that expenses align with your exempt purpose.

Freelancers and Independent Contractors

Freelancers and independent contractors, often operating under their Social Security number without a formal business entity, report their income and expenses on Schedule C. You can deduct hosting fees, website maintenance, and online tools as long as they are directly related to your freelance work, such as promoting your services or communicating with clients.

eCommerce Businesses

If you sell products online, whether through your site or marketplaces like Etsy or Amazon, your web hosting, domain, SSL certificates, shopping cart plugins, and other website-related costs are deductible. Classify these expenses under marketing, operations, or utilities depending on how each item supports your online store’s functionality.

No matter your business type, a smart tax strategy involves keeping detailed receipts, categorizing website-related expenses correctly, and ensuring that all deductions align with IRS requirements. Working with a qualified accountant or tax advisor can also help you structure your deductions most advantageously based on your business setup.

Conclusion

Running a business comes with its fair share of expenses, but tax season offers a valuable opportunity to reduce your financial burden through eligible deductions. As you’ve seen, web hosting and other website-related costs may qualify, but whether you can claim them depends on your unique business situation.

To avoid issues with the IRS, make sure you document your expenses carefully and consult a tax professional if you’re unsure. A little preparation now can help you maximize your return and minimize surprises later.

For a full list of deductible business expenses, please visit the IRS’s Deducting Business Expenses page.